When the FAFSAs release date was moved to Oct. The FAFSA requires applicants to use tax information from an earlier tax year not the year of application.

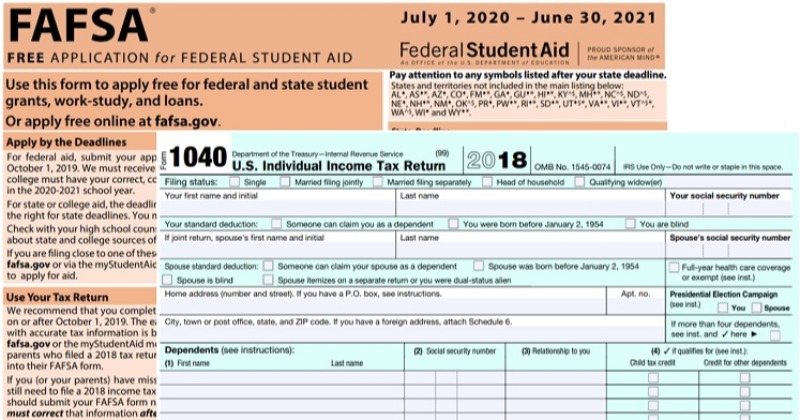

Federal Income Tax Form Simplification Complicates Fafsa Form

This question asks whether your parents have filed or will file a 2019 income tax return.

. While not required if you are eligible to use the IRS Data Retrieval Tool IRS DRT we highly recommend using the tool for several reasons. The date you receive your tax refund also depends on the method you used to file your return. For the FAFSA for the 2019-2020 school year youll use the information on your 2017 tax return not your 2018 return.

For example the 2022-2023 FAFSA will use income information in your 2020 tax return so 2020 would be the base year or prior-prior year. For the 2019-20 academic year students and their families will use their financial information from the 2018 tax return to complete the FAFSA. 2021 tax preparation software.

If you had income earned andor unearned in 2019 and you are a single dependent who can be claimed as a dependent on someone elses tax return you may still be required to file your own return. The Free Application for Federal Student Aid FAFSA bases income and tax information on a specific years federal income tax returns the prior-prior year. If your parents are now married even if they werent married in 2019 answer this question about them as a couple.

Taxpayers should always keep a copy of their tax return. September 21 2020. Here are some options for taxpayers who did not keep a copy of their tax return.

As a result applicants use tax information that is likely already filed. Your state or school might also have earlier requirements for filing or give more priority to those who filed by a certain date. Should I use IRS DRT on FAFSA.

1 in 2016 the rules about which years tax information to use were also updated. What tax year does FAFSA use for 2022-2023. Individual Income Tax Return electronically using available tax software products.

For the 2020-21 academic year students and their families will use their financial information from the 2019 tax return to complete the FAFSA. Start filing for free online now. Reasons to include 2019 taxes on the FAFSA.

Prepare federal and state income taxes online. The FAFSA questions about untaxed income such as child support interest income and veterans noneducation benefits may apply to you. You cannot update your 202223 FAFSA form with your 2021 tax information after filing the 2021 tax return.

This is question 79 on the Free Application for Federal Student Aid FAFSA PDF. 5 Records of Your Untaxed Income. Summer is quickly flying by and the 2019-2020 school year fast approaches.

Ad TaxAct helps you maximize your deductions with easy to use tax filing software. To allow families in need of financial aid to complete their FAFSA sooner the financial information from the previous years return is used. The 202223 FAFSA form requires 2020 information.

This year is often referred to as the base year or the prior-prior year. Efile your tax return directly to the IRS. The 2019-2020 FAFSA has been available to families since October 1st 2018 and you have until midnight Central Time June 30th 2020 to complete it.

However if your income has changed since the prior-prior year you can file a. The FAFSA requires applicants to use tax information from an earlier tax year not the year of application. Applicants filing a 2019-20 FAFSA must use data from their 2017 tax returns.

Filing FAFSA and Reporting Taxes. According to studentaidgov the inclusion of 2019 tax information will help enable the use of the IRS Data Retrieval Tool for transferring financial. In TaxAct if you import your 2018 return to your 2019 return this information will be imported into your FAFSA Tax Summary Worksheet.

The tool automatically enters your tax information exactly as it was submitted. Taxpayers should always keep a copy of their tax return. Whether they keep it electronically or on paper they should keep it in a secure place.

On the 202223 FAFSA form youll report. Whether they keep it electronically or on paper they should keep it in a secure place. This means no waiting on your next W2 to complete or update the FAFSA.

Use Tax Year Data. Applicants filing a 2019-20 FAFSA must use data from their 2017 tax returns. You can simplify the process by using the IRS Data Retrieval Tool.

If you need to amend your 2019 or 2020 Forms 1040 or 1040-SR you can now file the Form 1040-X Amended US. 100 Free Tax Filing. FAFSA - Change in Calculation from Year to Year.

In TaxAct if you import your 2019 return to. You cannot substitute income and tax information from a more recent year even if the information is available. Over 85 million taxes filed with TaxAct.

The amount of your 2019 income will determine whether or not you need to file. FAFSA Guide FAFSAAID Year Taxes to Use Semesters 2019-2020 2017 Taxes Fall 2019 Spring 2020 Summer 2020 2020-2021 2018 Taxes Fall 2020 Spring 2021 Summer 2021 2021-2022 2019 Taxes Fall 2021 Spring 2022 Summer 2022. You can simplify the process by.

If you submitted a tax return by mail the IRS. For the FAFSA for the 2019-2020 school year youll use the information on your 2017 tax return not your 2018 return. Students who need to file the 2019 FAFSA will need to use their income from their or their parents 2017 Federal Tax Return.

April 16 2020 UCanGo2.

Pin By Susana Villa On Fafsa Fafsa Hudson County Community College

Your Guide To The 2019 2020 Fafsa Application Earnest

How To Complete The Fafsa When Parent Didn T File Tax Return Fastweb

0 Comments